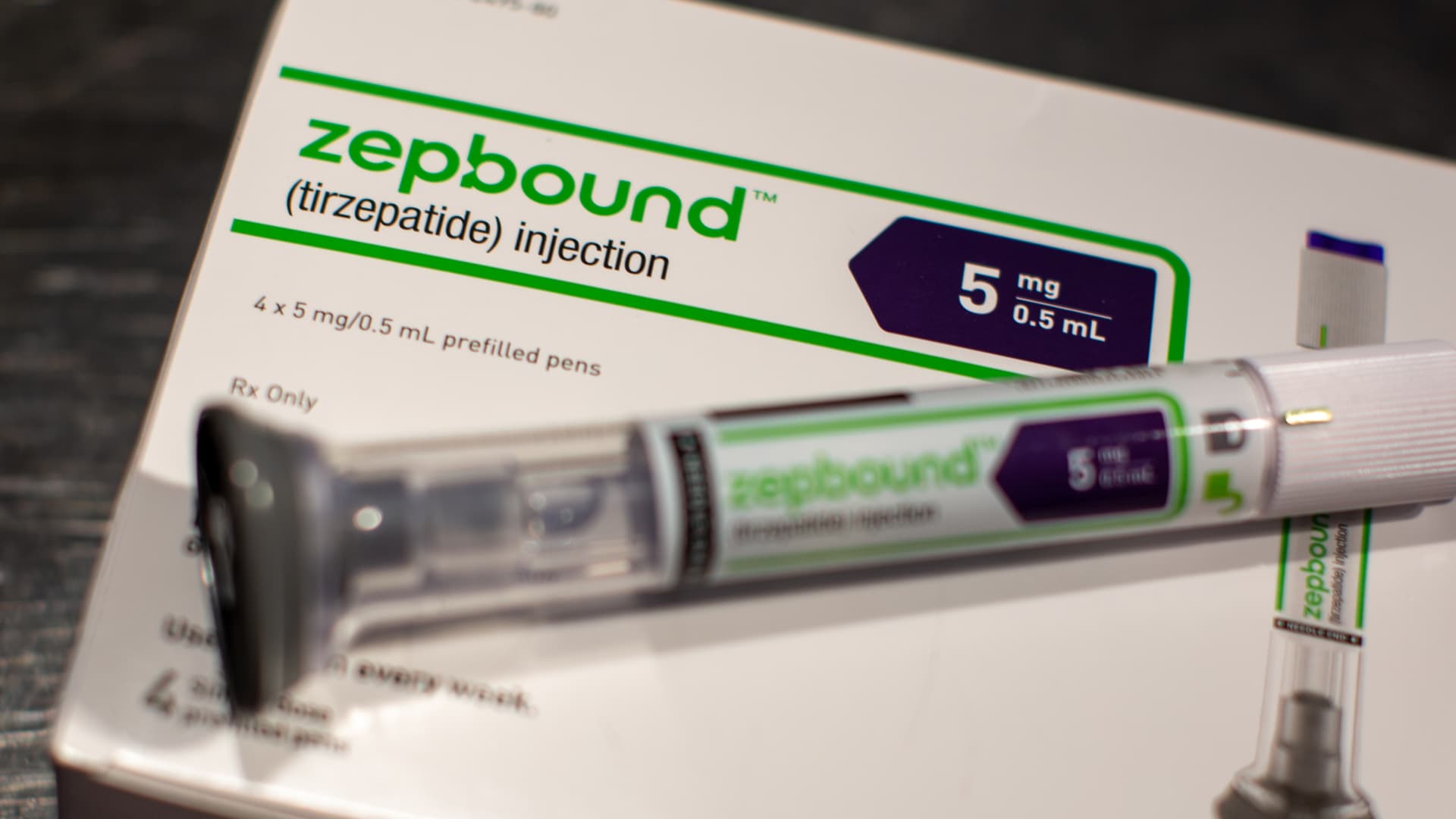

Every weekday the CNBC Investing Club with Jim Cramer holds a “Morning Meeting” livestream at 10:20 a.m. ET. Here’s a recap of Wednesday’s key moments. 1. Stocks were sharply higher Wednesday after a softer-than-feared consumer inflation report . The data follows a cooler wholesale inflation reading on Tuesday. The tech-heavy Nasdaq led the rally, up more than 2% higher. As for bonds, the 10-year Treasury yield dropped back below 4.7% “The relief in the bond market is helping the interest rate sensitive stocks,” such as Home Depot , said Jeff Marks, director of portfolio analysis for the Club. We added more Home Depot shares last week in anticipation that it should benefit from the Los Angeles wildfire rebuilding. Rate-sensitive Stanley Black & Decker shares were also getting a boost. Marks said that increased deal activity among homebuilders should bode well for both Club stocks. 2. Club financial firms started earnings season strong. BlackRock jumped 4% after issuing a top and bottom line beat Wednesday morning, along with strong operating margins. CEO Larry Fink was upbeat about the bank’s recent acquisitions, which should make up about 20% of BlackRock’s overall revenue. Wells Fargo rose 6% after the bank delivered a solid quarter. The company impressed with better-than-expected net interest income (NII). Marks said the “biggest blowout of the day” Goldman Sachs whose stock rose more than 4.5%. Goldman’s quarterly revenue increased 22% year over year while adjusted earnings per share (EPS) more than doubled. 3. Eli Lilly shares were flat Wednesday — stabilizing following Tuesday’s more than 6.5% decline on the company’s fourth-quarter preannouncement of lighter-than-expected GLP-1 obesity and weight loss drug sales. Lilly also saw softness in the third quarter, making the company and its stock a “show me story,” Marks said. This pullback, however, reset expectations, making the company’s targets more achievable, he added. With Eli Lilly stock still trading below $750 per share, we reiterated Tuesday’s stance that we would be buyers of additional shares if not restricted. (Jim Cramer’s Charitable Trust is long HD, SWK, BLK, WFC, GS, LLY. See here for a full list of the stocks.) As a subscriber to the CNBC Investing Club with Jim Cramer, you will receive a trade alert before Jim makes a trade. Jim waits 45 minutes after sending a trade alert before buying or selling a stock in his charitable trust’s portfolio. If Jim has talked about a stock on CNBC TV, he waits 72 hours after issuing the trade alert before executing the trade. THE ABOVE INVESTING CLUB INFORMATION IS SUBJECT TO OUR TERMS AND CONDITIONS AND PRIVACY POLICY , TOGETHER WITH OUR DISCLAIMER . NO FIDUCIARY OBLIGATION OR DUTY EXISTS, OR IS CREATED, BY VIRTUE OF YOUR RECEIPT OF ANY INFORMATION PROVIDED IN CONNECTION WITH THE INVESTING CLUB. NO SPECIFIC OUTCOME OR PROFIT IS GUARANTEED.