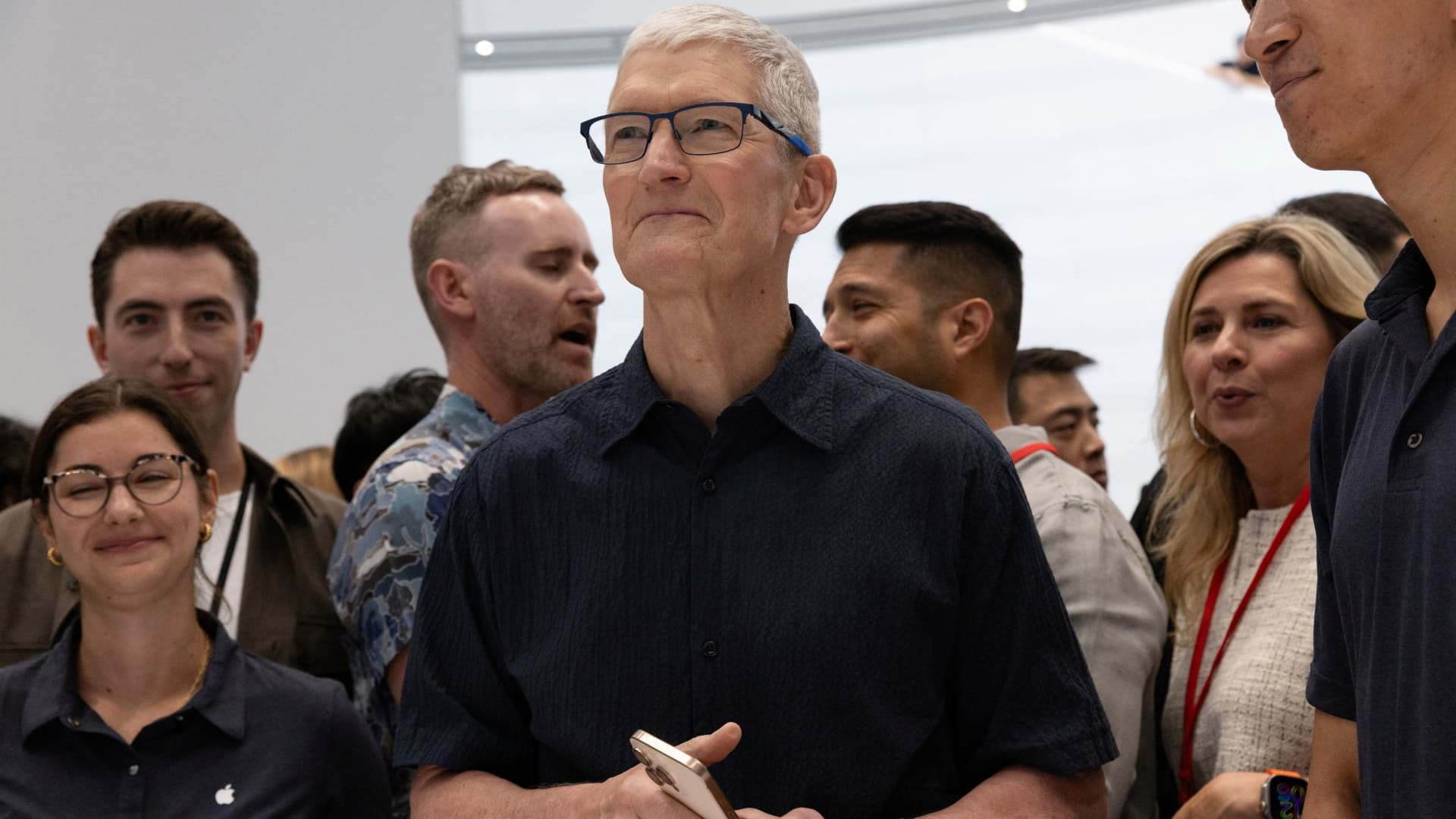

CEO of Apple Tim Cook poses as Apple holds an event at the Steve Jobs Theater on its campus in Cupertino, California, U.S. September 9, 2024.

Manuel Orbegozo | Reuters

Apple shareholders on Tuesday rejected a request to abolish its Inclusion & Diversity program, signaling that investors still see value in the company’s diversity programs.

The proposal, submitted by the National Center for Public Policy Research, was voted down at Apple’s annual shareholder meeting.

The proposal pushed Apple to cease its diversity, equity and inclusion, or DEI, and it cited CNBC reporting that found companies such as Alphabet, Meta, Microsoft and Zoom were rolling back their diversity programs. It requested that Apple get rid of its program, policies, department and goals, arguing that diversity programs may discriminate and that the compliance risk threatens Apple’s bottom line.

“The risks to Apple stemming from continuing to push these divisive and value-destroying agendas is only increasing in light of President Trump’s recent executive order focusing the Department of Justice on rooting out illegal discrimination being carried out in the name of DEI,” NCPPR Executive Director Stephen Padfield said at the meeting. “The vibe shift is clear. DEI is out, and merit is in.”

Apple opposed the measure, saying it’s already compliant with employment laws and that the proposal inappropriately seeks to micromanage the company’s programs.

“Our strength has always come from hiring the very best people and then providing a culture of collaboration, one where people with diverse backgrounds and perspectives come together to innovate and create something magical for our users,” Apple CEO Tim Cook said.

Despite opposing the measure, Cook did warn that the legal landscape around diversity issues may force Apple to make changes.

Even before President Donald Trump was elected in November, diversity programs have been scaled back across the corporate world. A key driver was a 2023 Supreme Court ruling that found affirmative action in college admissions was unconstitutional.

Companies like Amazon, McDonald’s, Target, Ford, Lowe’s and Walmart have abandoned or scaled back DEI initiatives. When Trump took office last month, one of his first executive orders sought to end federal government DEI programs.

Apple has inclusion programs ranging from internal support groups, features for people with disabilities and research efforts to ensure company products and services don’t display racial bias, according to the company’s website.

Nearly two-thirds of the company’s workforce is male, and 35% is female, according to the company’s website, which cites figures from 2022. The website also states that 42% of employees are white, and 30% are Asian.

Other proposals

Apple shareholders also shot down outside proposals to create reports on the company’s ethical AI data usage, the costs and benefits of different approaches to fight child exploitation and charitable giving.

Investors also shot down a proposal from the National Legal and Policy Center that focused on its OpenAI partnership. It suggested that Apple’s deal with OpenAI may contradict its focus on privacy, and urged the company to prepare a report about the risks of using private or unlicensed data to train artificial intelligence.

The company opposed the proposal, saying it already provides information about its AI data privacy practices.

Shareholders did approve Apple’s slate for board of directors, its auditor and the company’s executive compensation in an advisory vote.

That included Cook’s annual compensation. He was paid $74.61 million in salary in 2024, stock awards and bonuses, up from $64.21 million in 2023. In documents provided to shareholders, Apple touted that its market cap had risen by over $3 trillion during Cook’s tenure.

At the meeting, Cook talked about a $500 billion earmark for U.S. spending announced on Monday that was hailed by Trump.

“The U.S. is our home, and we’re deeply committed to the country’s future,” he said.

Additionally, Cook said Apple is planning to increase its dividend annually and will update investors in May about the increase this year.

“We’ve also paid out more than $165 billion in dividends, including $15.3 billion in just the last four quarters,” Cook said.

WATCH: Apple to invest $500 billion to play role in powering Apple Intelligence