Reuters

ReutersThe Trump administration and Elon Musk’s Department of Government Efficiency (Doge) have moved to take control of – and possibly shut down – an agency set up to protect consumers in the wake of the 2007-8 financial crisis.

The Consumer Financial Protection Bureau (CFPB) oversees banks and holds vast troves of consumer data.

As part of the US Federal Reserve, the CFPB is an independent agency, however Trump’s budget director was installed as its director on Friday, and Doge officials have gained access to the agency’s computer systems.

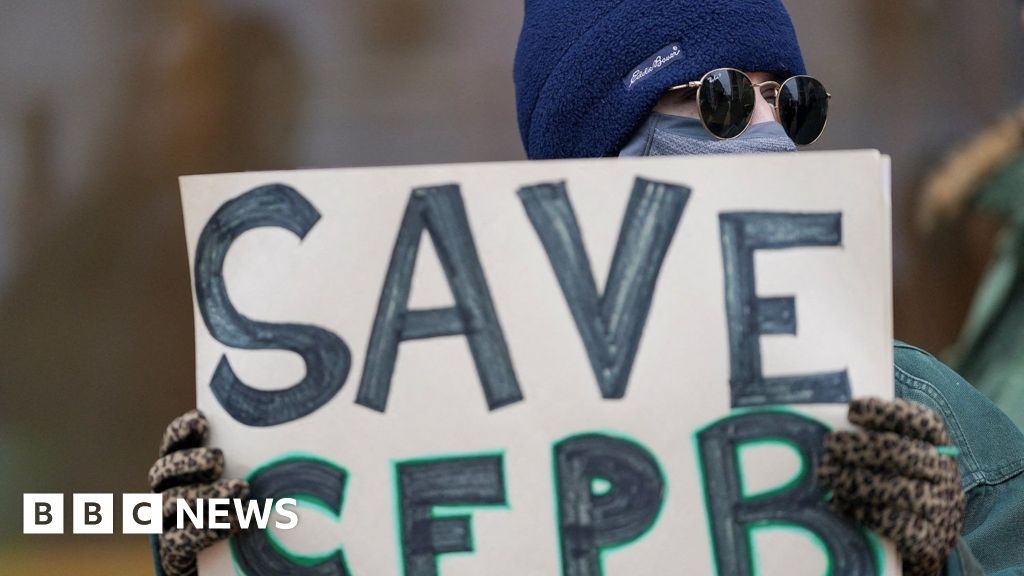

About 100 workers protested outside the CFPB’s office on Saturday.

The agency is the latest department of the US government to be targeted by Doge, an unofficial cost-cutting group that Donald Trump has given broad leeway to slash government spending and remove employees.

Musk and Doge have already spearheaded the effort to eliminate USAID, the main US foreign aid agency, and employees of Doge have also reportedly been seen in several other federal government departments.

The number of Doge personnel, its budget and its operating structure is unclear. Musk and the White House have provided few details about Doge operations, and names of Doge employees have mostly come from leaks by government employees.

CBS, the BBC’s US news partner, reported that DOGE representatives have gained access to the internal systems of CFPB, including personnel rolls and financial records.

The Wall Street Journal reported Friday that representatives of Doge had gained “read-only” access to CFPB computer systems.

The agency regulates banks and financial institutions with more than $10bn (£8bn) in assets.

It was established in 2011 as part of reforms after the upheaval of the Great Recession in 2007-8, which was triggered in part by a crash in the US subprime mortgage lending market.

It has about 1,750 employees and an annual budget of $758m.

It fields complaints about financial products from customers and has some power to make consumer finance rules. In 2024, for instance, it limited credit card late fees to $8 (£6.45), although that rule change has been delayed by a legal challenge.

The agency has long been a target of Republicans who have accused it of overreach, unduly restricting banks, and using money from fines and settlements to fund left-wing activist groups.

The front page of the CFPB website returned an error message on Saturday, however much of the rest of the site appeared to be operating as normal.

Top Democrat on the House Financial Services Committee, Maxine Waters, has released a statement that claimed Doge was “systematically killing the CFPB”.

“Musk’s takeover of the CFPB is a five-alarm crisis and a frightening violation of millions of Americans’ data privacy. As it stands, Musk can now see the personal information of people who, after being swindled by bad actors, reached out to the CFPB in a moment of desperation,” Waters said.

Waters said this data could include bank statements, credit card information, Social Security numbers, and medical information.

In a statement, the National Treasury Employees Union, which represents CFPB employees, said Doge’s activities amounted to a “potentially dangerous incursion”. The union said it would pursue all avenues to protect the private data of consumers and financial institutions.

On Friday Musk wrote “CFPB RIP” on his X account. Posting several times an hour, he repeated allegations of widespread criminality, fraud and abuse across government and indicated that he would attempt to close the bureau.

Last month, President Trump fired the CFPB director Rohit Chopra, who was appointed by President Joe Biden, and installed Treasury Secretary Scott Bessent as head of the agency.

But on Friday, Trump made another switch, giving control of the agency over to Russell Vought, the newly approved director of the Office of Management and Budget.

Vought was an author of Project 2025, a list of proposals issued by the Heritage Foundation think tank – one of which calls for the CFPB to be abolished.

The BBC contacted the CFPB, the White House, and a Doge spokeswoman for comment.