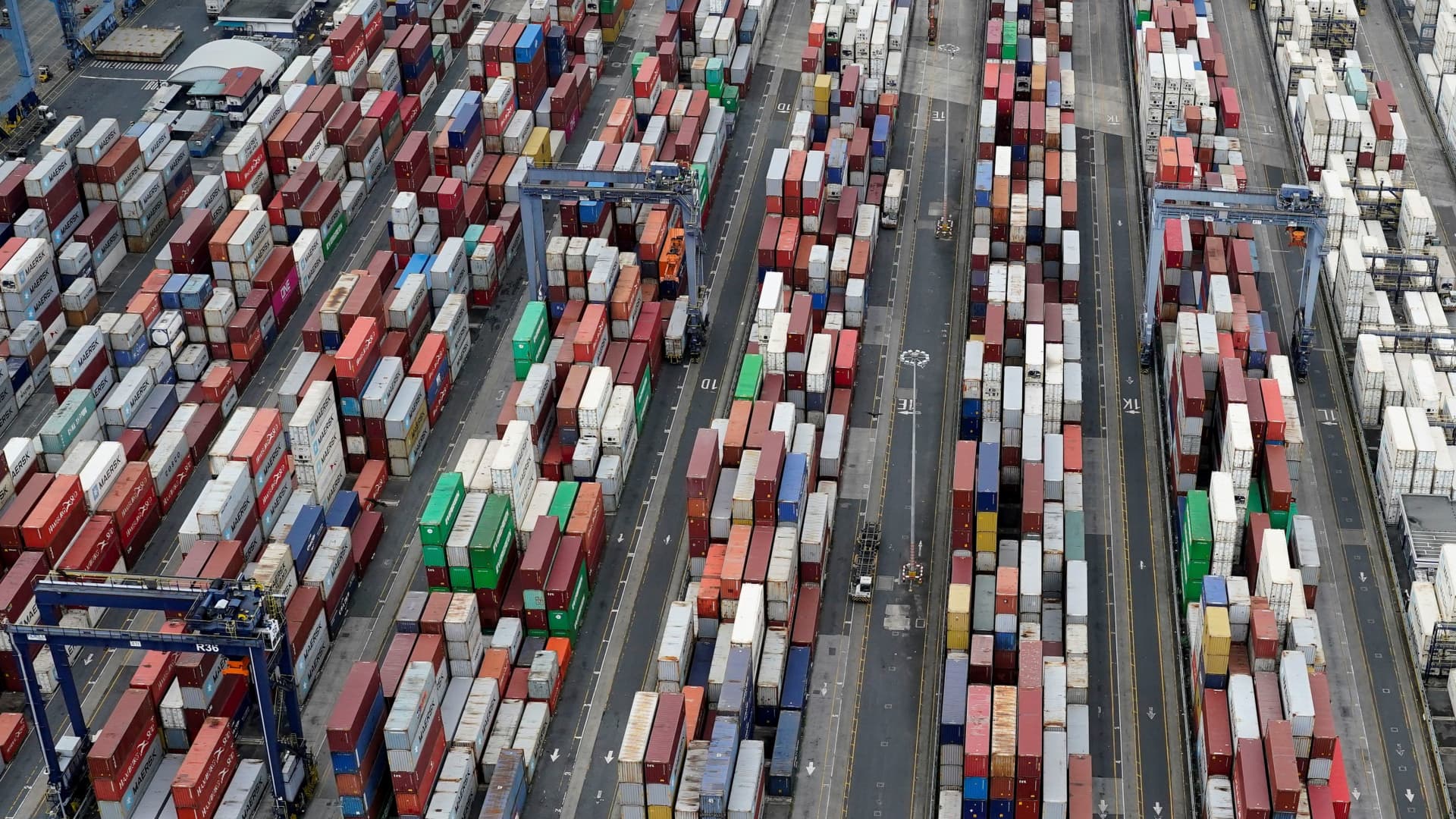

An aerial view shows stored containers at the Balboa Port, operated by Panama Ports Company, as U.S. President Donald Trump plans to regain control of the Canal, in Panama City, Panama, February 1, 2025.

Enea Lebrun | Reuters

This report is from today’s CNBC Daily Open, our international markets newsletter. CNBC Daily Open brings investors up to speed on everything they need to know, no matter where they are. Like what you see? You can subscribe here.

What you need to know today

Trump tariffs take effect

U.S. President Donald Trump launched a salvo of tariffs on Saturday. Imports from Mexico and Canada will be hit with a 25% duty, while those from China will be subject to a 10% tariff. Energy resources from Canada will face a lower 10% tariff. The tariffs on Canadian goods are expected to take effect on or after 12:01 a.m. ET on Tuesday. Canada’s Prime Minister Justin Trudeau announced on the same day retaliatory tariffs of 25% against $155 billion in U.S. goods.

Inflation remained steady in December

Wall Street ended 2024 on a high, but so did inflation in the U.S. The personal consumption expenditures price index rose 2.6% on an annual basis in December, reported the U.S. Commerce Department on Friday. That’s up 0.2 percentage points from November and in line with the Dow Jones estimate. Core PCE, which removes food and energy prices, came in flat from the previous month at 2.8%, also in line with expectations.

For stocks, a winning January amid uncertainty

U.S. markets retreated Friday, giving up earlier gains, on news of Trump’s impending tariffs. The S&P 500 lost 0.50%, the Dow Jones Industrial Average slid 0.75% and the Nasdaq Composite fell 0.28%. However, all three indexes ended January in the green. That said, stock futures tumbled on Monday morning. The pan-European Stoxx 600 index ticked up 0.13%, notching a 6% gain for January — higher than the S&P 500’s increase of 3%.

DeepSeek might have cost 100 times more

Chinese artificial intelligence startup DeepSeek’s sophisticated AI model purportedly cost just $5.576 million to train, according to a technical report. That number excludes costs of prior research, compute expenditure and other processes. A new report from SemiAnalysis, a semiconductor research and consulting firm, estimates that DeepSeek’s hardware spend is “well higher than $500M over the company history.”

[PRO] Week packed with earnings — and questions

Earnings season kicks into high gear this week, with more than 120 S&P 500 companies scheduled to report. Investors and analysts won’t only be pouring through the results, they’ll also want to scrutinize how CEOs respond to questions about Trump’s tariffs. Meanwhile, the January jobs report will be out Friday, and economists’ expectations for it are slightly muted.

The bottom line

U.S. President Donald Trump’s tariffs are no longer a threat but a reality. They cap off a wild January during which a new president entered the White House and a new Chinese artificial intelligence model upended the industry.

Something else that was new in January: the highest-ever closing level for the S&P 500.

But with tariffs now in place, a potential trade war brewing — making it more difficult for inflation, seemingly stuck in place, to recede — markets might find it difficult to scale new heights in the near term.

Even Big Tech earnings and the jobs numbers coming out this week, typically market-moving reports, are likely to play second fiddle to policy developments.

A small consolation to markets: The total cost of DeepSeek might be more than $500 million, a research firm estimated. (The $5 million figure stated by DeepSeek comprises just its training cost.) It might give AI-related companies a spring in their steps.